A Republican-Sponsored Tax Hike

The budget proposed by state House Republicans raises the personal income tax by over $2 billion. Having no budget deal is a better outcome than this one.

Back in 2011, when Republicans ended a 140-year walk in the political wilderness and took control of both chambers of North Carolina’s General Assembly for the first time since 1870, one thing that was dead certain: voters could count on conservative Republicans not to increase taxes.

Raising taxes was such a bright red political line for North Carolina Republicans that when faced with a $3.7 billion dollar state budget deficit during the Reform Majority’s first budget cycle, conservatives allowed a scheduled 1-cent sales tax reduction and scheduled reduction of the personal and corporate income taxes to go into effect. Republican House Speaker Thom Tillis and Senate President Pro Tempore Phil Berger correctly called Democratic Governor Bev Perdue’s plan to delay those tax cuts a "tax increase."

The reform majority in the legislature adopted a two-pronged philosophy on taxes that was referred to tongue-in-cheek as “Ruchonomics” after its biggest proponent, former Senate Finance Committee Chairman Bob Rucho.

The first part of the philosophy was that taxes like the income tax or franchise tax that penalized earning, wealth generation, and holding assets were unfair and disincentivized investment, productivity, and work. Unlike income taxes, sales and excise taxes that tax consumption and spending were fairer because they do not disincentivize investment, productivity, and work.

The second part of the philosophy was that tax policies should not pick winners and losers -- a single, low tax rate levied on a broad tax base was the fairest and most pro-growth state tax policy. To this end, legislators eliminated hundreds of millions, if not billions, of dollars' worth of tax loopholes and carveouts to flatten and reduce North Carolina's tax rates.

The philosophy paid enormous dividends for the North Carolina economy, dramatically increasing the state’s gross domestic product and the family incomes of North Carolinians over the last decade. Forbes, US News and Site Selection magazines have all repeatedly cited North Carolina as the top, or one of the top, states in the nation for business.

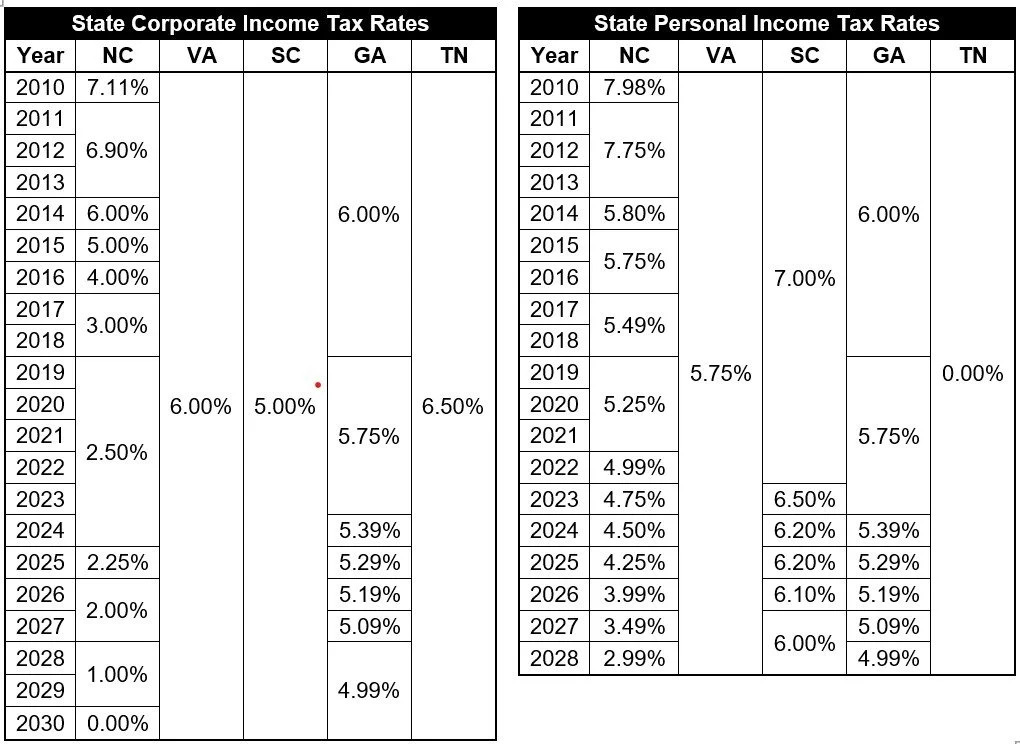

As a result of this conservative approach, North Carolina went from having the highest income taxes in the region to the lowest income taxes in the region. Under current tax law, North Carolina is projected to see two more half-percent reductions in the personal income tax rate in 2027 and 2028, lowering the rate to 2.99% and another half-percent reduction in 2031 lowering the rate to 2.49%. In fact, in 2030 North Carolina will become the first state in the country to eliminate an income tax when the state's corporate income tax phases out.

In recent years, over a dozen states have replicated the tax reform model North Carolina initiated a decade ago. If North Carolina stops moving forward or, worse, starts sliding backwards, the state will lose the competitive advantage it worked so hard to gain.

This policy principle of reducing taxes has been an article of faith among North Carolina conservatives. It is a plank that has been firmly nailed into the platform of the North Carolina Republican Party for decades.

But it isn't just good policy, it has been great politics. Fighting tax increases and the legislators who voted for them has been a powerful weapon for conservatives. This is true in GOP primaries where the issue has been used to knock off moderate Republicans like Richard Morgan, and true in general election campaigns where it has helped unseat Democrats like Joe Sam Queen, Howard Hunter and James Galliard. As recently as last month House Republicans were on the attack against House Democrats over raising taxes.

But with House Republicans releasing and planning to vote for a budget proposal that increases personal income taxes on North Carolinians by over $2 billion dollars, the policy principle is in peril, and House Republicans are suddenly in grave danger of being attacked politically for raising income taxes in upcoming primary and general elections.

Income tax increases are a litmus test for groups like the Club for Growth and AFP that play outsized roles in Republican congressional primaries. A vote for a $2 billion income tax increase is certain to paint a target on the back of any House Republican with congressional aspirations.

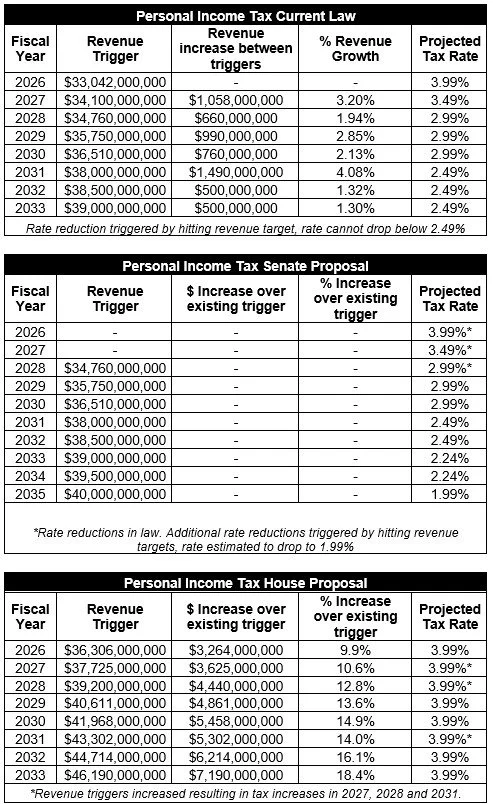

These charts show the differences in personal income tax rates under current law, the Senate Budget proposal and the House Budget proposal. As you can see, the Senate locks in the personal income tax cuts and adds triggers that would likely result in two additional quarter point reductions that would lower the personal income tax rate all the way down to 1.99% in future years.

On the other hand, the House INCREASES the personal income tax triggers by over $3 billion this year and by a staggering $7 billion in later years to ensure that North Carolina taxpayers will pay far more in personal income taxes than they would if the scheduled cuts in current law took effect.

Tax reformers in the House and Senate have offset income tax cuts in previous years by expanding other tax bases and by closing tax loopholes. Importantly, if the House wanted to offset the scheduled income tax cuts, they had several options that, unlike a $2 billion personal income tax increase, would have aligned with the state’s previous, successful approach.

The sales tax on services, which applies to things like installations, car repairs and other maintenance work, could easily be expanded to apply to services like haircuts, manicures, massages, gym memberships, housecleaning, and landscaping maintenance.

The sales tax on services doesn't only have to apply to blue-collar jobs, it could also be applied to white-collar professional services like accounting and legal work. The sales tax could also be applied to services like individual sports bets and goods like lottery tickets. New lottery games could be authorized and taxed. There are several options for closing tax loopholes like reducing the non-profit sales tax exemption enjoyed by the state’s huge hospital systems and private universities. The sales tax exemption on electricity used by datacenters that consume huge amounts of energy and drive-up power costs for all North Carolinians could be eliminated.

Finally, there are a number of excise taxes that could be increased like the tax on out-of-state sports betting companies that was increased in the Senate budget proposal.

Any of those changes would adhere to the tax philosophy that has been instrumental in North Carolina's economic growth over the last decade while avoiding the political and policy pitfalls of voting for a two-billion-dollar-plus personal income tax hike on hardworking North Carolina families.

Strangely, the House budget does not spend most of the tax increase they are passing. Because the tax revenue they’re raising is not being spent, it would be easy for House members to avoid this politically dangerous vote to increase taxes and simply stick with the state’s existing triggers and tax policy.